Child Tax Credit 2024 News Now – the IRS website You have a modified adjusted gross income, or MAGI, of $200,000 or less, or $400,000 or less if you’re filing jointly. Note: . Congress may be on the verge of doing something big: passing a bill to bring back a smaller version of pandemic-era expanded tax credits. They could lift half a million kids out of poverty by next .

Child Tax Credit 2024 News Now

Source : www.marketplace.org

EV tax credits 2024: VERIFY Fact Sheet | wusa9.com

Source : www.wusa9.com

EV tax credit rules in effect, more than 20 models lose eligibility

Source : www.cbtnews.com

Lawmakers Strike Deal on Expanded Child Tax Credit, but Face Long

Source : www.nytimes.com

2024 Child Tax Credit Big News For Families #learnontiktok

Source : www.tiktok.com

CASH Coalition | Rochester NY

Source : www.facebook.com

Giving Parents More Cash Is a Start—But It Can’t Be the End Ms

Source : msmagazine.com

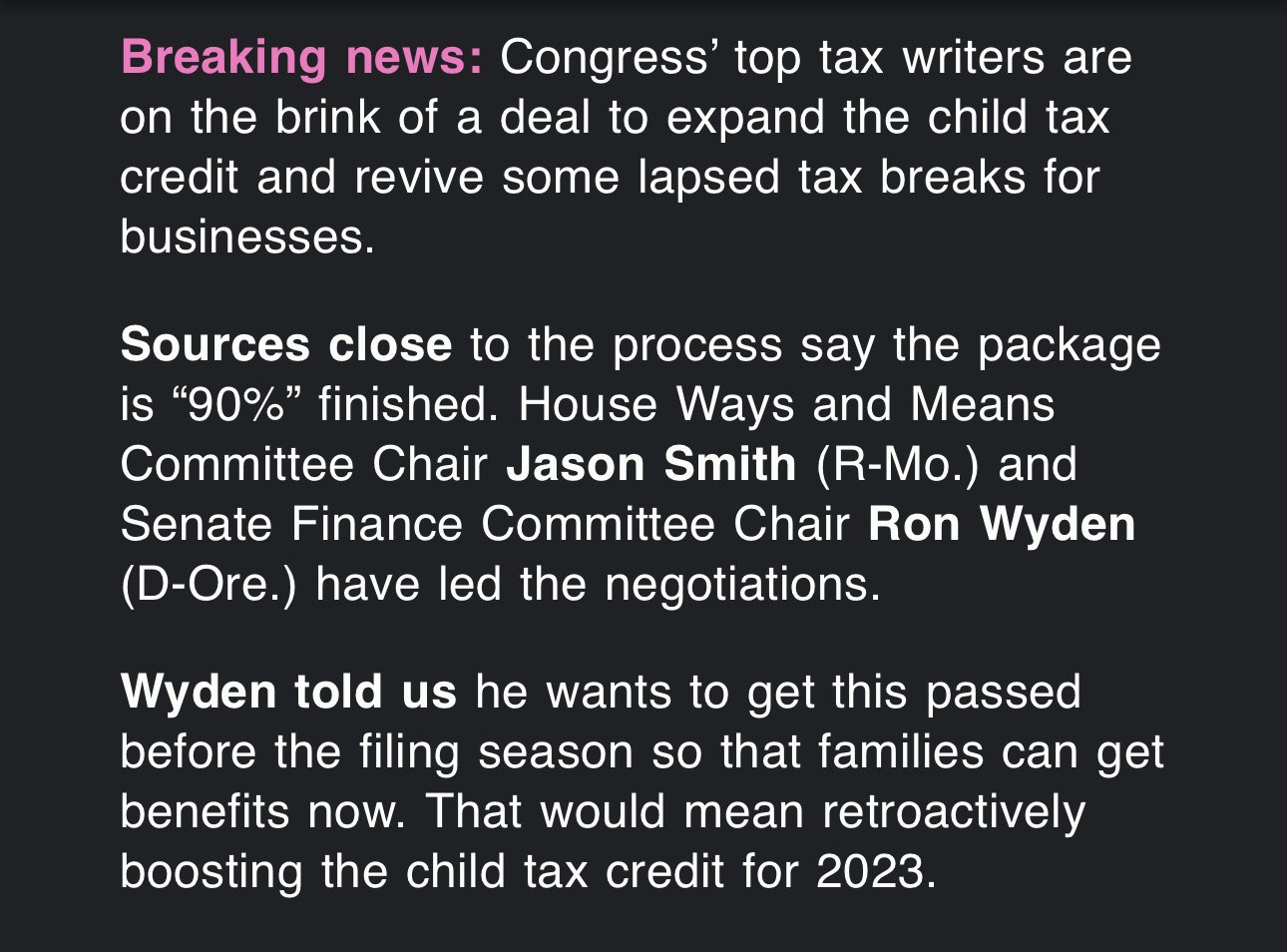

Brendan Pedersen ???? on X: “TAX NEWS: Bipartisan tax deal is almost

Source : twitter.com

Lawmakers unveil longshot $78 billion deal to expand child tax

Source : www.wral.com

Only 13 Cars Qualify For 2024 EV Tax Credit Under New Rules

Source : www.bloomberg.com

Child Tax Credit 2024 News Now Here’s what’s in the new bill to expand the child tax credit : Congressional negotiators announced a roughly $80 billion deal on Tuesday to expand the federal child tax credit that, if it becomes law, would make the program more generous, primarily for low-income . Under the proposed legislation, the child tax credit would increase the maximum refundable child tax credit to $1,800 for 2023 tax returns, $1,900 for the following year, and $2,000 for 2025 tax .